fed helicopter money march-april 2020

Tags: finance

-

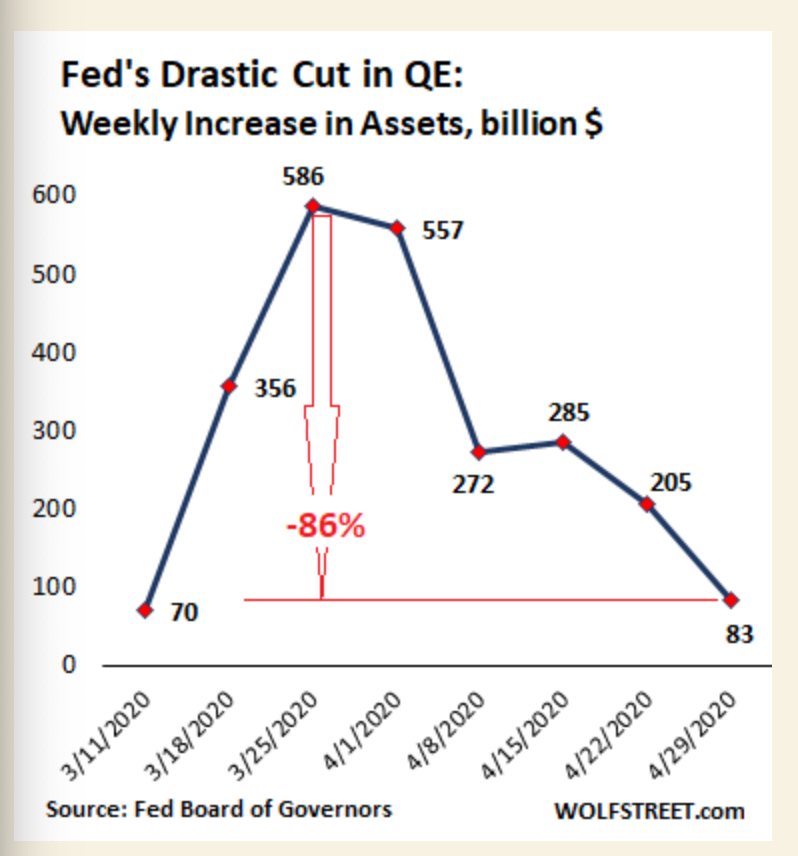

FED QE has dramatically slowed down since 2nd week of March

-

Same QE playblock as before, front load the bailout and cut back asset purchases

MBS

- Balance of MBS’s have actually fallen

- MBS’s take weeks to actually settle

- Why?

- Boom in mortagage refinancing

REPO

- Repo purchases have stalled, big REPO ops are being leftover from a few weeks ago

SPV (special purchase vehicles)

- Technically gets around limits imposed by the Federal Reserve Act FED Powers

- Remained steady at ~162 b

- Composed of:

- Primary credit

- Secondary Credit

- Seasonal Credit

- Primary Dealer credit

- Money Market Mutual Fund

- Paycheck Protection Program

Central Bank Repos

- BoJ largest user

- 49%

- 214 bil

- ECB second biggest

- 32%

- 142 bil

-

7 days or 84 day maturities